An accrued expense can be an estimate and differ from the supplier’s invoice, which is in a position to arrive at a later date. Following the accrual method of accounting, bills are recognized when they’re incurred, not necessarily when they’re paid. On the opposite hand, a lower in accrued bills occurs when a company pays down its excellent accounts payable on a later date. Therefore, a lower in accrued bills does not affect the earnings assertion. Creating journal entries for accrued expenses requires a structured method. First, determine the incurred but unpaid expense, which could range from utilities to salaries.

Higher Monetary Planning And Decision-making

In this instance, credit score the Cash account since you paid the expense with money. This clarity helps higher budgeting, more correct forecasting, and stronger financial reporting. It’s particularly useful when making use of for loans or presenting performance to traders or partners. For instance, if your organization makes use of electrical energy by way of December 31 but doesn’t obtain the bill until January 5, you need to accrue the utility expense in December. Whichever you resolve to implement, you could find that you need some additional help.

For a deeper look into expense administration, take a look at our managed accounting companies. For businesses trying to streamline monetary processes, together with accrued expense management, FinOptimal provides tailor-made solutions. Our experience in accounting automation helps improve accuracy, cut back handbook effort, and provide priceless insights into your monetary information. We understand the challenges of managing accrued bills, from tracking employee wages and advantages to calculating interest and utility prices. Our Accruer software program, for example, automates the creation of correct journal entries, lowering handbook errors and guaranteeing compliance with the matching principle.

- Understanding the distinction between accrued bills and outstanding bills is crucial for correct monetary reporting.

- Accurately recording accrued expenses directly impacts a company’s financial ratios.

- A company often attempts to e-book as many precise invoices as it may possibly throughout an accounting interval earlier than closing its accounts payable (AP) ledger.

- Learn on to learn the fundamentals of accrued liabilities to keep your small enterprise money circulate on track.

- For assist managing bills, discover our managed accounting providers.

This saves time and offers a clearer view of your company’s monetary health, as detailed in our Accrued Bills Guide. Beyond software program, our Managed Accounting Companies offer professional help for all of your accrual accounting wants, from setup and implementation to ongoing reconciliation and review. We work with companies to grasp their specific necessities and develop customized options that improve monetary reporting and streamline operations. Contact us to discuss how we might help automate your accrued expense administration and enhance your financial reporting. If you are keen about finance and expertise, discover our profession alternatives. Accrued bills immediately impact the accuracy of your monetary statements.

Comparability To Cash Basis Accounting

This consists of utilities, lease, salaries, and any other recurring bills. Recording these accrued bills ensures your month-to-month financial statements are correct. This common evaluate prevents errors and keeps your monetary information clean. For extra particulars on how accrued bills affect your monetary statements, explore this guide. Hire or lease payments for workplace area or gear also fall into this class.

Banks favor accrual as a outcome of it reveals what you owe and what’s coming in, not simply the cash you have proper now. It gives a full view of your cash situation, which is superior if you’re asking a financial institution for a loan or attempting to impress people who would possibly back your project. For example, if you tutor someone and ship them a bill midway by way of the month, you count that cash instantly.

Commerce associations or on-line assets usually publish knowledge on typical expenses for specific industries. Whereas much less exact than your individual data, these benchmarks offer a useful starting point. Regardless of your methodology, document the assumptions made in your estimations.

Recording bills when they’re incurred—rather than when they’re paid—gives you a clearer view of your profitability and obligations throughout each accounting interval. It helps you match costs to income more precisely, which improves decision-making and long-term planning. The cash foundation of accounting involves recording revenue when it’s obtained and expenses when they’re paid. It stands in distinction with the accrual foundation, which involves recording income when it’s earned and bills when they’re incurred—no matter when money really changes palms. An accrued expense occurs when a company buys supplies but hasn’t acquired the invoice but. Other accrued bills are curiosity on loans, warranties, and taxes, that are incurred however not but invoiced or paid.

For advanced recurring accruals, this automation could be a lifesaver, liberating you from tedious duties and allowing you to concentrate on higher-level monetary administration. Discover FinOptimal’s Accruer software program for an answer designed to streamline these processes. Accrual accounting may appear to be a big-company idea, however it’s critical for small companies, too.

A subsequent true-up is required when the actual invoice is acquired. If the value of the accrued expense was estimated, then this adjusting entry shall be an estimate. As Quickly As you pay the cash, an adjustment is created to eliminate the account payable, included with the accrued expense earlier.

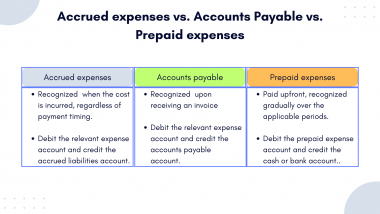

Conversely, prepaid bills involve paying for one thing https://www.intuit-payroll.org/ earlier than you obtain the products or services. A common example is insurance—you pay premiums in advance for coverage over a particular interval. The key difference boils right down to the timing of the fee relative to whenever you really receive the benefit. They’re usually made at the beginning of the accounting period following the one during which the expense was accrued. So, should you accrued an expense in December, you’d reverse the entry on January 1st.