The guide worth of one share of cumulative most well-liked stock is its call price plus any dividends in arrears. If a 10% cumulative preferred inventory having a par value of $100 has a call value of $110, and the corporation has two years of omitted dividends, the book worth per share of this preferred inventory is $130. An various to having Appropriated Retained Earnings showing on the balance sheet is to reveal the precise scenario within the notes to the financial statements.

Accruing tax liabilities in accounting involves recognizing and recording taxes that an organization owes however has not but paid. This is important for correct monetary reporting and compliance with… A dividend reduces the amount in Retained Earnings since it’s the distribution of earnings. The company is taking cash out of the enterprise to offer to homeowners (shareholders). Proactive communication with shareholders relating to the strategic value of these initiatives is essential in making certain their overall success. However, the impression of these initiatives on shareholders’ equity is not totally adverse.

Retained earnings are a part of shareholder equity, as is any capital invested within the firm. The most typical method in balance sheet accounting is to subtract liabilities from property to get equity. From this evaluation, we can see how the company’s equity has evolved as a outcome of varied factors like profitability, share buybacks, and dividend insurance policies. This real-world software underscores the importance of the assertion in evaluating a company’s financial standing. Retained earnings replicate the portion of net income that’s retained by the company quite than distributed to shareholders as dividends.

In different words, most popular stockholders receive their dividends earlier than the widespread stockholders receive theirs. If the company doesn’t declare and pay the dividends to most popular stock, there can’t be a dividend on the common inventory. In return for these preferences, the popular stockholders often surrender the right to share within the corporation’s earnings which are in excess of their stated dividends. Many investors view firms with adverse shareholder fairness as dangerous or unsafe investments. But shareholder equity alone isn’t a definitive indicator of a company’s monetary health.

What Is The Accounting Equation

- For investors, the Statement of Stockholders’ Equity is an important piece of the puzzle.

- Sales are reported within the accounting period during which title to the merchandise was transferred from the seller to the customer.

- A statement of shareholders’ equity additionally could be helpful for buyers who want extra details about a single part of the company’s possession.

- As stated earlier, it’s the declaration of money dividends that reduces Retained Earnings.

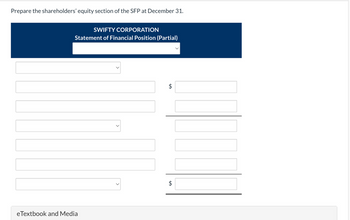

It supplies detailed info on changes from inventory issuance, dividend funds, share repurchases, and shifts in retained earnings or accumulated other comprehensive revenue. This excessive stage of transparency aids stakeholders in understanding the corporate’s monetary wellbeing and efficiency in utilizing its resources for progress. The statement of stockholder’s equity displays all equity accounts that affect the ending fairness https://www.simple-accounting.org/ balance together with widespread inventory, web earnings, paid in capital, and dividends. This in depth view of equity is greatest demonstrated in the expanded accounting equation. Let’s look at the stockholders’ equity section of a steadiness sheet for a corporation that has issued solely frequent inventory.

Protective Put: Understanding, Examples, And Situations

Nevertheless, if a state legislation requires a par (or stated) value, the accountant is required to record the par (or stated) value of the widespread stock within the account Common Inventory. The board of administrators formulates the corporation’s insurance policies and appoints officers of the corporation to carry out those policies. The board of administrators also declares the quantity and timing of dividend distributions, if any, to the stockholders.

Tips On How To Learn A Cash Flow Statement

Here is an instance of tips on how to prepare a statement of stockholder’s fairness from our unadjusted trial stability and monetary statements used in the accounting cycle examples for Paul’s Guitar Store. To grasp the connection totally, let’s start with where these statements join. The Statement of Shareholder Equity reflects the modifications in fairness over a particular time-frame, including new equity investments, retained earnings, or loss, and any paid dividends. To see a statement of stockholders’ fairness, search the web by entering a corporation’s name and the words investor relations 10-K. Approximately half way down on the table of contents you will see Financial Statements.

It facilitates insights into how efficiently the corporation manages its assets, therefore enjoying a decisive position in investment choices. Gradual growth in shareholders’ equity can showcase the company’s fiscal stability and resilience, making it a viable choice for funding. On the contrary, a declining fairness pattern may sign potential purple flags, prompting an investor to rethink their determination.

Retained earnings, as the name implies, mirror the features and losses carried forward to the subsequent monetary 12 months. It is the quantity left with or stored apart by the company after it pays the dividend from internet income. Usually, the buyers and corporations resolve to reuse this quantity and reinvest the identical within the firm. This formulation takes into consideration the capital that was paid for shares, added to the retained earnings minus the treasury shares, which the company had beforehand issued, but repurchased. This method helps decide a company’s net value, exhibiting how a lot would stay for shareholders in spite of everything liabilities were paid off.

One of the first steps in studying tips on how to make an announcement of stockholders’ fairness is knowing its elements. Widespread stocks, although they may be more part of the choice course of, such as the election of the board of directors in the company, they are paid after the preferred stockholders, creditors in terms of liquidation. There is far to assume about when making a stockholders’ fairness assertion, like various kinds of stock and any additional gains or losses. While calculating these amounts, don’t go away any of these details out of the equation. The cost of equity is one other important measure to gauge when analyzing a shareholders fairness statement.

You ought to consider our materials to be an introduction to selected accounting and bookkeeping subjects (with complexities doubtless omitted). We focus on monetary statement reporting and do not focus on how that differs from earnings tax reporting. Subsequently, you want to all the time consult with accounting and tax professionals for assistance along with your particular circumstances. To illustrate, let’s assume that 1,000 shares of common stock are exchanged for a parcel of land.